A pulse on the Global Financial Markets.

Research, analysis and advisory on Artificial Intelligence, Machine Learning and Blockchain within Capital Markets. Additionally all major and niche asset classes such as Alternatives asset classes are our focus. We have been active in this area since 1997 on Wall Street in New York, now based in London. Our clients comprise of Investment Banks, Fund Managers, Commodity Trading Houses, Oil Majors and Global Funds - including long-only and absolute return fund managers, either structured as UCITS or hedge funds.

Our team include MBA's and PhD's from some of the leading universities in London all within Capital Markets and Finance.

Our capabilities and experiences extend across all major asset classes: Fixed Income, Equity, FX and Commodities markets including Futures and Options trading, Oil, Gas, Power, Coal, Carbon, Base & Precious Metals, Steel and Softs.

Regulatory deliverables: MIFID II (see presentation in Projects section below), AIFMD, EMIR, Dodd-Frank, ESMA and GDPR.

At the heart of our business are our specialist consultants within the following space: Business Analysis, Business Architecture, Project Management, Programme Management and Governance.

Examples of our consultants project deliverables include:

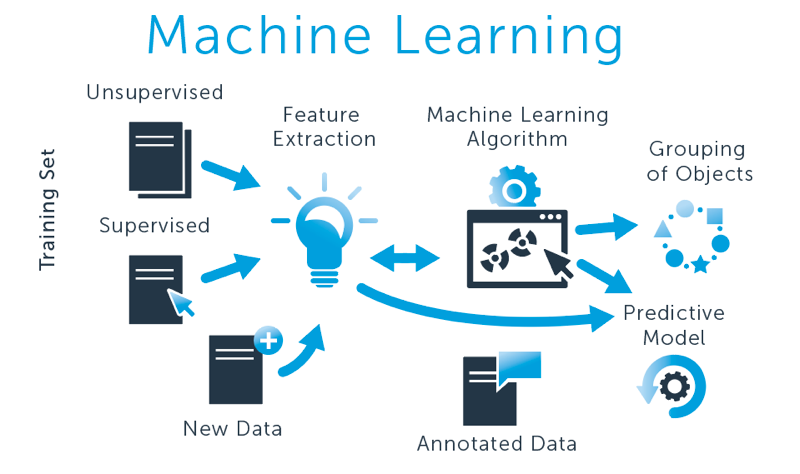

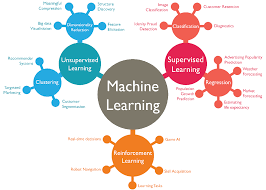

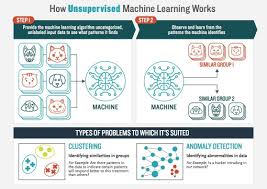

- Marketsflow - Machine Learning and Artificial Intelligence Portfolio Mgmnt

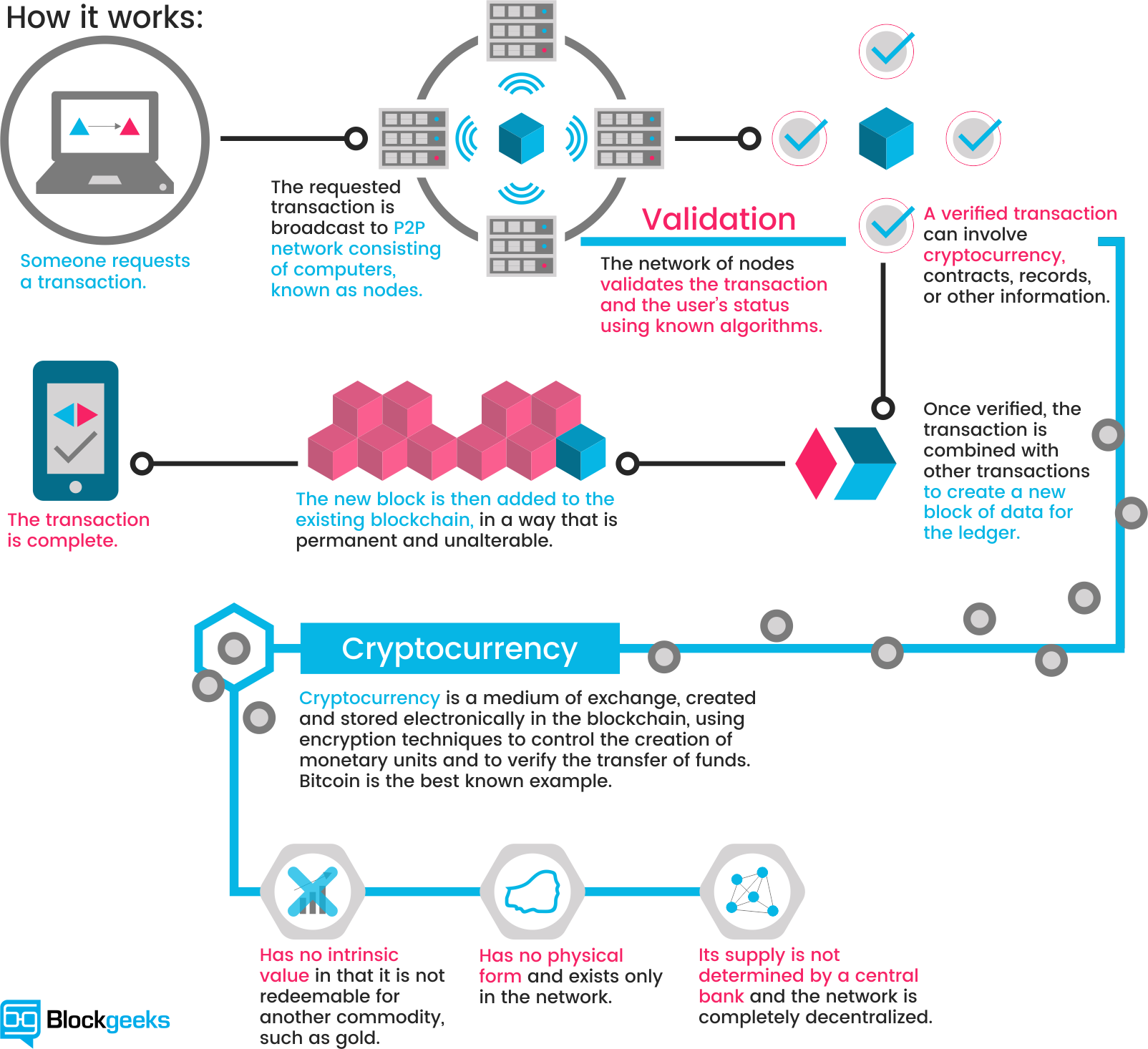

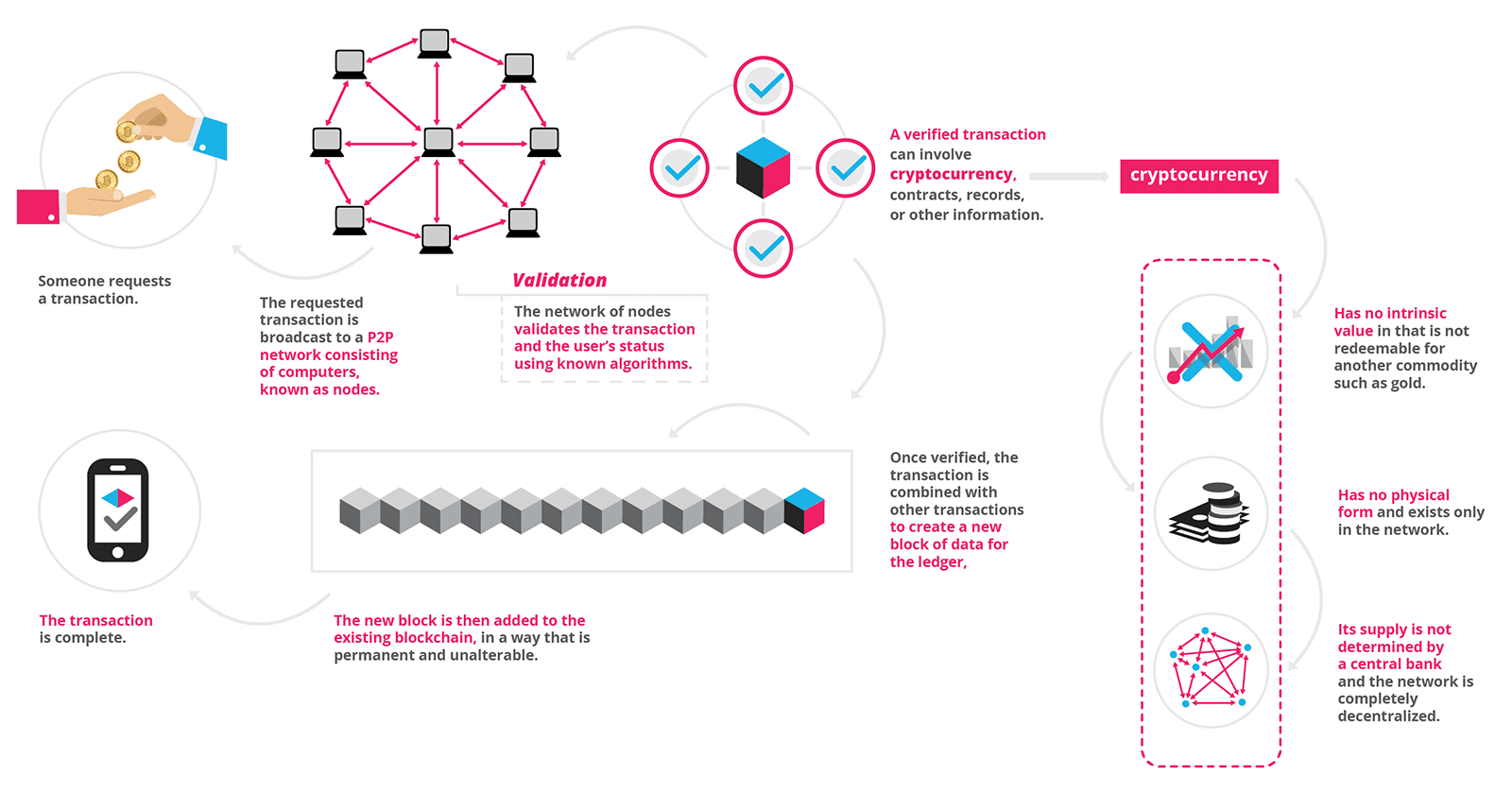

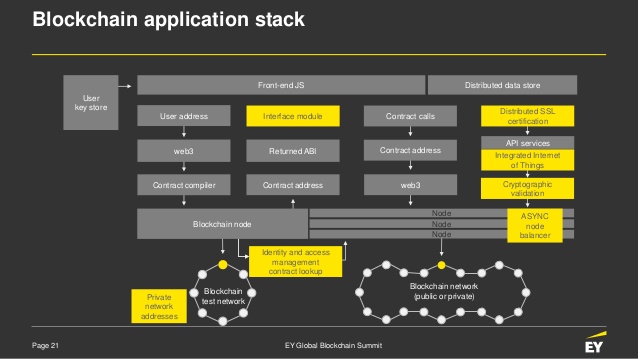

- NEX - Blockchain open architecture trading platform for Capital Markets

- JP Morgan - Swaps Transactions capture to settlements

- BAML: Commoditites Trading, PnL Explained, Risk Perturbations, POC's

- Credit Agricole - Front office process capture of Commodities

- SWIP - Multi Manager Diversified Alpha - UCITS fund launch

- HSBC - AIFMD submission

- FINSA - Business & Functional Architecture - Brokerage

Services we provide:

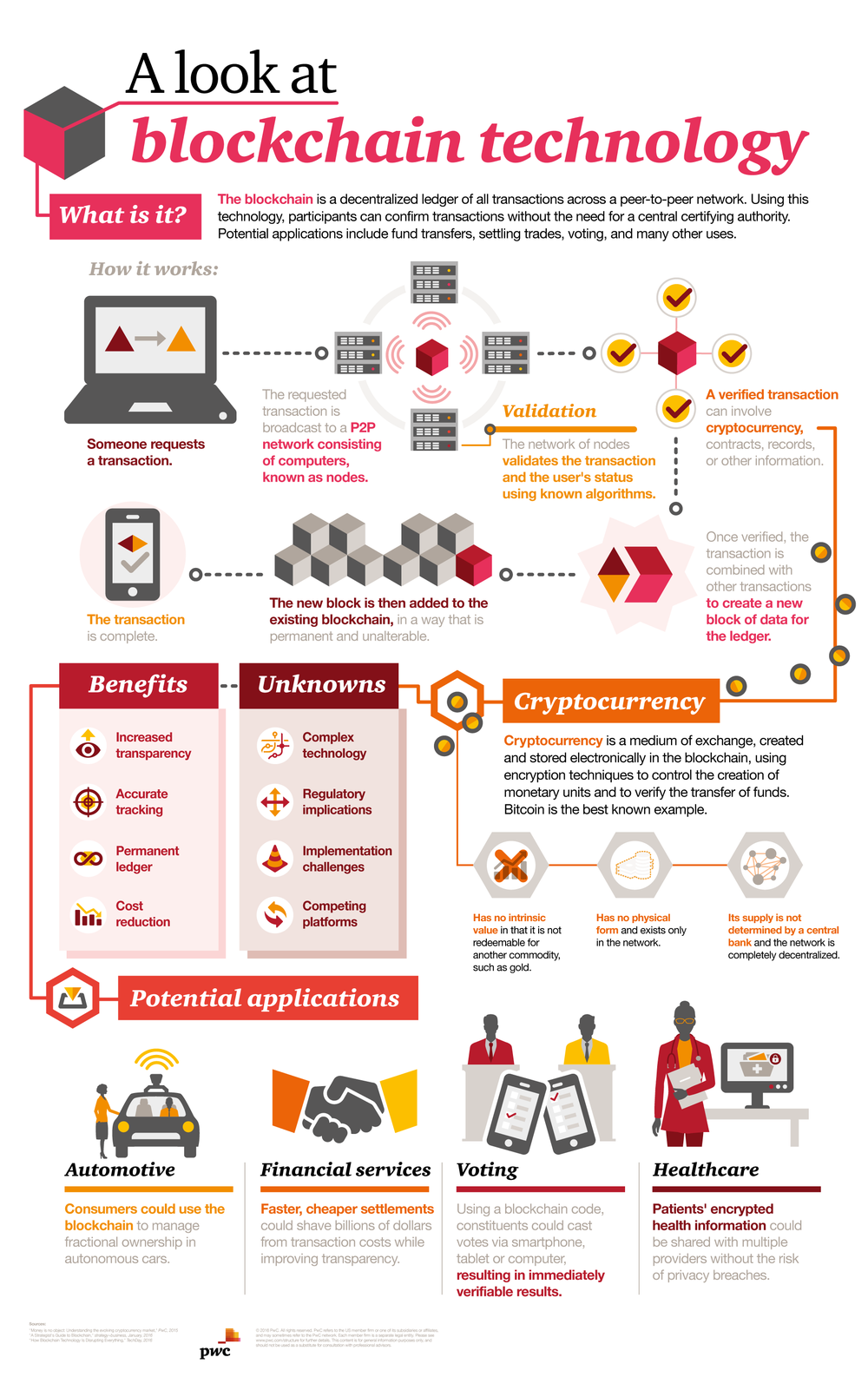

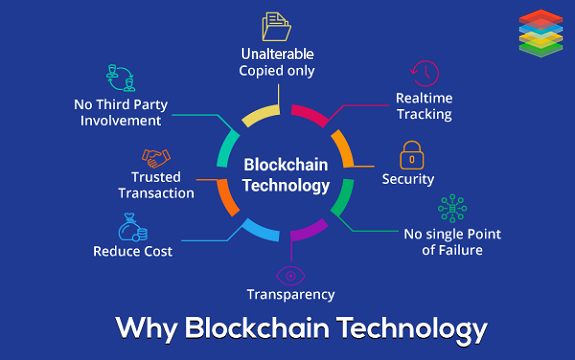

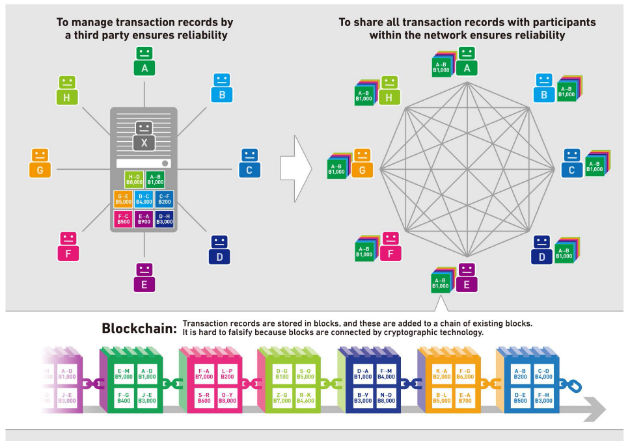

- Analysis of Blockchain in Capital Markets - defined Use Cases

- Artificial Intelligence platform vendor selection and 3rd party engagement

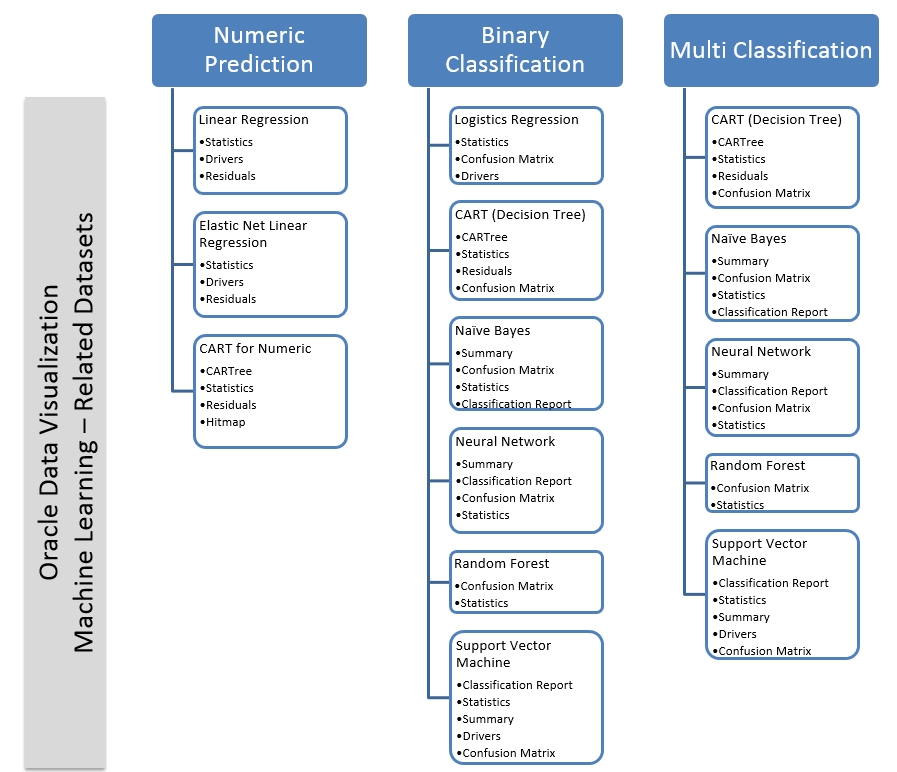

- Machine Learning techniques proposals and recommendations

- Integration of FinTech platforms within Trading environments

- Financial Markets functional architecture solutions

- Target Operating Models - Future State Business Architecture

- Research on ESG issues, themes, and trends affecting companies, industries and financial markets, to identify, analyse, maintain and process ESG data

- Trade Data - Messaging protocols: FIX, FpML, Swift

- Conversion of Business Requirements into Technical functionality

- Source Code control management

- Best Practice: Configuration Management

- Programme/Project Management methodology: Scrum, Agile, Waterfall, Extreme, RUP

- Front to Back Trading Workflow solutions architecture

- Regulatory impact analysis, Governance Framework: control frameworks